Dividend Information

Basic Policy for the Distribution of Profits

The Company regards the distribution of profits to shareholders as important management issues, and it has adopted a basic policy of continually offering steady dividends with an eye on the consolidated payout ratio as it strives to strengthen its earnings capabilities and develop sound financial strength. In addition, it will undertake a share buyback when necessary as part of flexible capital policies and comprehensive measures to return profits to shareholders.

Moreover, the Company will invest internal reserves for the enhancement of its financial strength, as well as M&As to facilitate the Group’s growth, business development, training of human resources, research and development from the medium-to long-term view, and the improvement of productivity and quality control capabilities. In this way, it will strive to strengthen its comprehensive corporate capabilities and the Group’s business foundations to achieve sustainable growth.

The Company pays dividends twice a year: interim dividends and year-end dividends. The decision on whether to pay dividends lies with the Board of Directors in regard to interim dividends, and the General Shareholders Meeting in regard to year-end dividends.

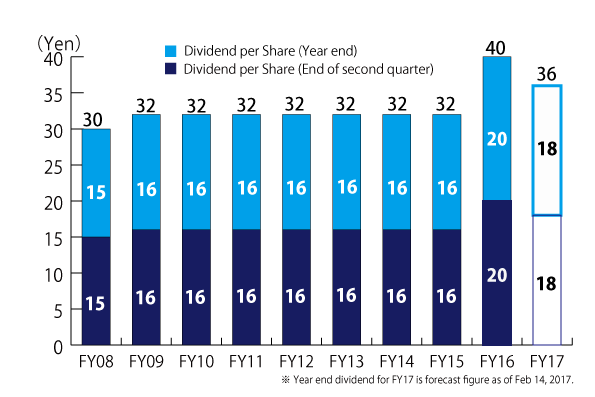

Dividend Trends

| Interim Dividends per Share (JPY) |

Year-end Dividends per Share (JPY) | Full Year Dividens per Share (JPY) |

|

|---|---|---|---|

| FY ended December 2017 | 18(Forecast) |

18(Forecast) |

36(Forecast) |

| FY ended December 2016 | 20(Note 1) |

20(Note 1) |

40(Note 2) |

| FY ended December 2015 | 16 | 16 |

32 |

| FY ended December 2014 | 16 | 16 | 32 |

(Note1)Breakdown : Ordinary dividends/\16、Commemorative dividends/\4

(Note2)Breakdown : Ordinary dividends/\32、Commemorative dividends/\8

Dividend Graph