Medium-Term Strategy

CAC Vision 2030

Creating new value on a global level with the use of the latest ICT

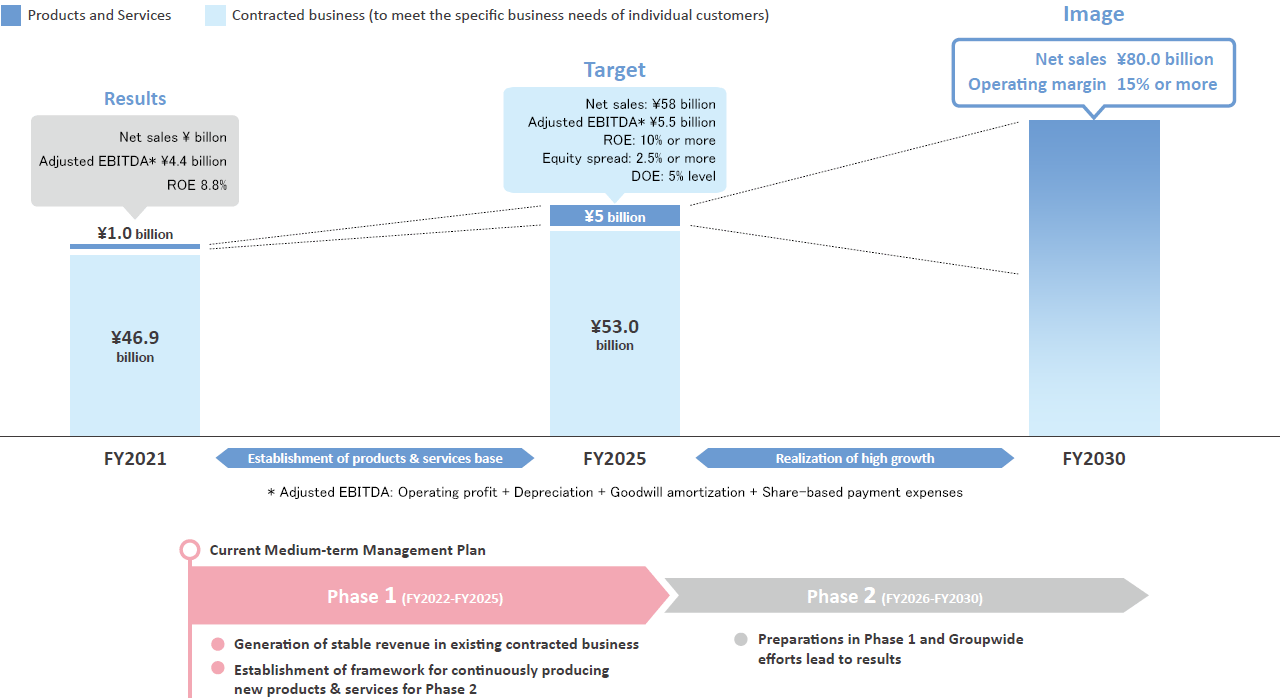

In a turbulent situation in which it is hard to predict three or four years in advance, we first discussed the direction the CAC Group should take and the kind of Group it aspires to be in 2030, 10 years from now, and formulated the CAC Vision 2030 “Evolving into a corporate group that consistently makes a positive impact on society, with technologies and ideas,” aiming to achieve sustainable growth, unaffected by short-term volatility.

On the CAC Vision 2030, we provide the means through digital technology such as AI and IoT and data for people to be able to demonstrate their diverse imagination and creativity, and create digital solutions to social issue. Then, We aim to become a highly profitable, high-growth corporate Group through the creation and growth of numerous digital solutions which have such a positive impact. The quantitative image and positioning of the medium-term management plan are as follows.

Numerical targets

Medium-term Management Plan - Phase 1 (FY2022-FY2025)

Period for earning stable revenue in existing contracted business and for building framework for continuously producing new products & services in preparation for phase 2

- Growth strategies

-

Products and Services

- Building of framework/business base for continuously establishing new businesses

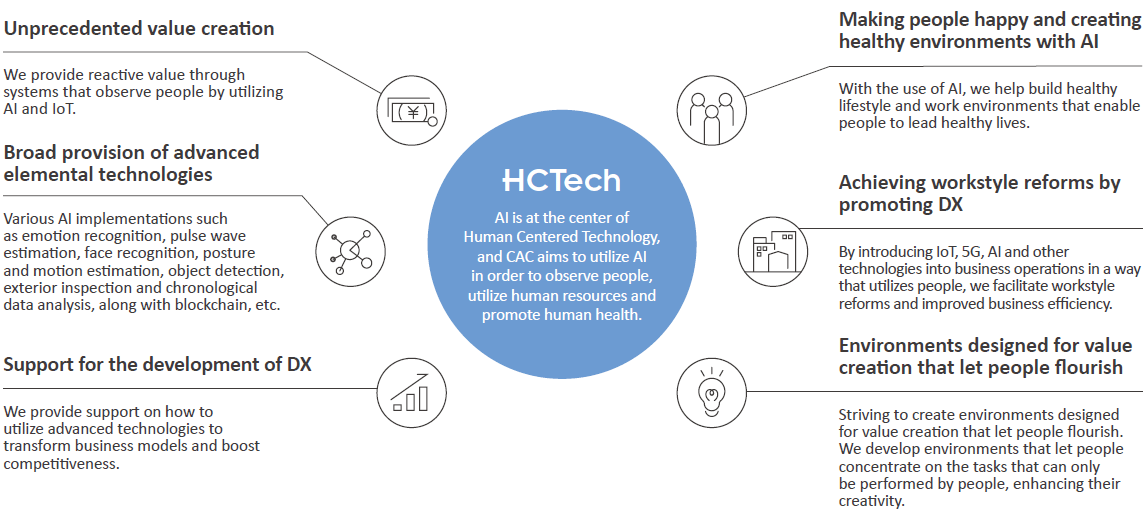

- Collaborative creation based on the concept Human Centered Technology

- Implementation of business investment and investment in human resources Approx. 15 billion yen

Existing contracted business

- Achievement of growth alongside expansion in internal resources

- High-profit strategy

-

- Reorganization of unprofitable business

- Improvement of management efficiency

- Improvement of approx. 1 billion yen

- Review and develop corporate capabilities

-

- Review of Group governance structure and operating method

- Reform of organizational culture

CAC solution concept for the DX eraHuman Centere Technology