Corporate governance

Basic approach

At the CAC Group, we have established the Basic Policy on Corporate Governance to fulfill our social responsibilities for our shareholders and various other stakeholders (including our customers, business partners, society and employees) and achieve the medium- and long-term improvement in our corporate value in accordance with our Corporate Philosophy, ”CAC Vision 2030", “Five Values” and Sustainability Basic Policy. Under this basic policy, we continue striving to strengthen our corporate governance.

Corporate Philosophy of the CAC Group

Creating new value on a global level with the use of the latest ICT

CAC Vision 2030

Envolving into a corporate group that consistently makes a positive impact on society, with technologies and ideas

Five Values

- Creativity

- Humanity

- Challenge

- Respect

- Pride

Sustainability Basic Policy

- We aim to be a company where employees can feel comfortable and that offers worthwhile work

- We help build a rich society through co-creating with our stakeholders

- We engage in corporate activities that have a positive impact on the environment

Basic structure of governance and management execution system

At the CAC Group, we have been strengthening governance aiming for open management with an emphasis on the transparency of management.

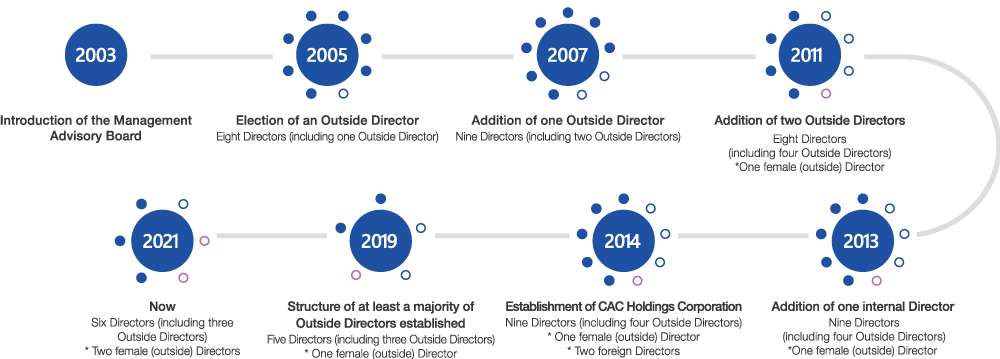

In 2003, we set up the Management Advisory Board and began to take initiatives for obtaining advice and recommendations about corporate governance from external specialists.

In 2005, we made the change to a management system that includes Outside Directors. Currently (as of March 24, 2021), our Board of Directors consists of six Directors, three of whom are Outside Directors (one man and two women).

All of the Outside Directors are independent officers.

In 2014, we made the switch to a pure holding company structure to speed up the formulation of business strategies for the entire group and the business administration of group companies.

In 2019, we separated management decision-making and supervising functions from executive functions for the purpose of further strengthening corporate governance.

The Board of Directors determines management policies and strategies for the entire group and supervises business execution of the Executive Officers, while the Executive Officers focus on business execution in line with the policies determined by the Directors.

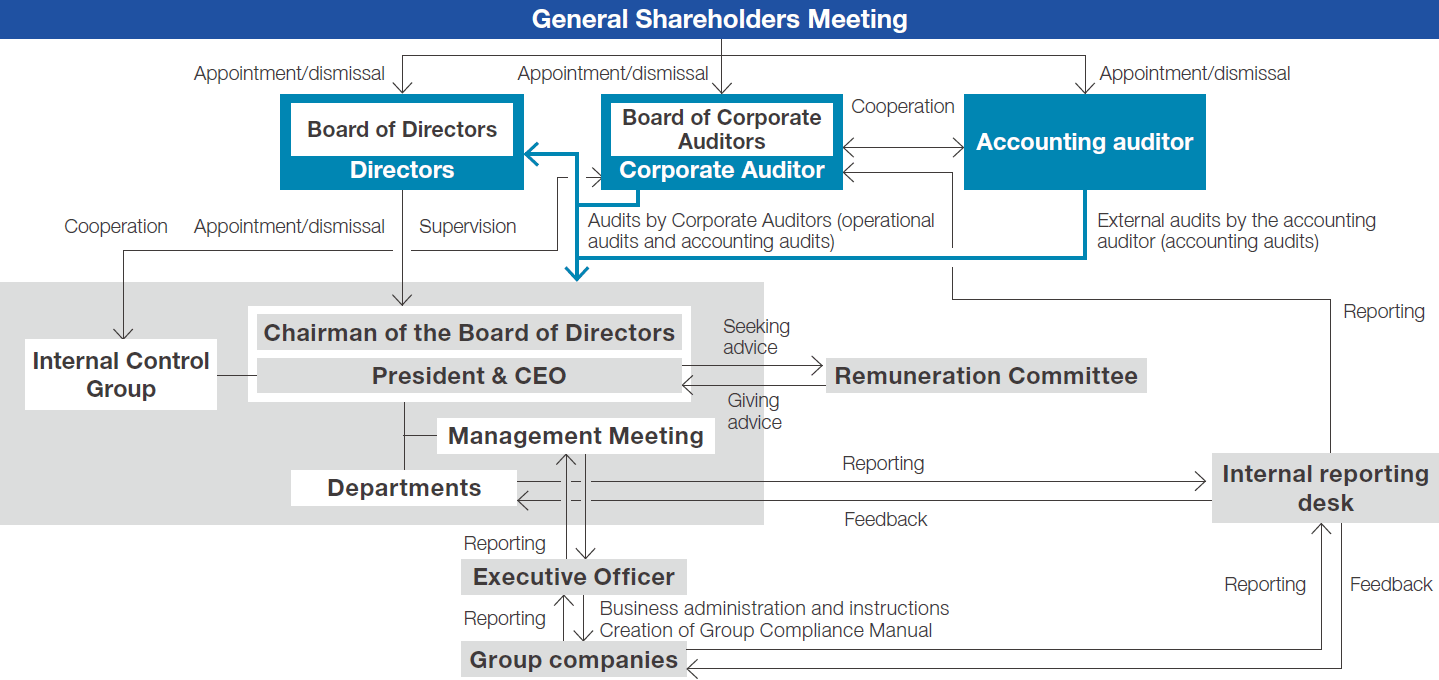

Board of Directors

The Board of Directors meets regularly every month and as needed.

Important matters are submitted for discussion at the Board of Directors, and the status of operations is reported as needed.

The Management Meeting has also been established as a body that deliberates and makes decisions on the execution of important business for the entire CAC Group. In principle the Management Meeting convenes twice a month and on an ad hoc basis whenever needed, and endeavors to facilitate the agile execution of business.

The Management Meeting is made up of the President & CEO and other persons they nominate.

Board of Corporate Auditors

Our Board of Corporate Auditors consists of four Corporate Auditors, two of whom are Outside Corporate Auditors.

They meet regularly every month and as needed to hold discussions aimed at ensuring the adequacy and appropriateness of decisions made by the Board of Directors.

Corporate Auditors actively participate in Management Meetings and other important meetings in addition to the Board of Directors Meetings to properly monitor Directors in the performance of their duties.

Reinforcement of the governance system

Corporate governance system chart

Remuneration Committee

The amount of remuneration, etc. for Directors is determined by the Board of Directors on the basis of a comprehensive assessment of each Director’s role and level of contribution within an upper limit resolved at the General Shareholders Meeting, to serve as an incentive for the medium- to long-term improvement of corporate value.

The amount of remuneration, etc. for Corporate Auditors is determined through discussion by Corporate Auditors, comprehensively taking into account factors such as whether each corporate auditor is a full-time or part-time Corporate Auditor and the distribution of auditing operations among Corporate Auditors, while making sure the range does not exceed the upper limit approved at the General Shareholders Meeting.

The Remuneration Committee, which is chaired by an Outside Corporate Auditor (Yuichi Ishino), was established as an advisory committee for the purpose of deliberating the appropriateness of remuneration for Directors, etc.

Moreover, to promote value sharing with shareholders, the Company introduced a restricted stock program at the 53rd Annual General Shareholders Meeting held on March 27, 2019.

Amount of remuneration for officers in FY2020

| Position | Number of officers |

Total amount of remuneration in millions of yen |

Breakdown | Upper limit of the amount |

|---|---|---|---|---|

| Directors (Outside Directors) | 6 (3)* | 131 (12) | Base remuneration: \90 million Stock-based remuneration: \16 million Bonus: \25 million (Only base remuneration was paid to Outside Directors) |

Up to \240 million per year |

| Corporate Auditors (Outside Corporate Auditors) |

4 (2) | 45 (9) | Base remuneration only | Up to \4 million per month |

| Total | 10 (5) | 176(21) | - | - |

*This includes one Outside Director who stepped down in March 2020.

Notes

- The upper limit of the amount of remuneration for Directors, which is 240 million yen per year (excluding the amount of employee salaries), was approved at the 40th Annual General Shareholders Meeting held on March 30, 2006.

- The upper limit of the amount of remuneration for Corporate Auditors, which is 4 million yen per month, was approved at an extraordinary General Shareholders Meeting held on December 11, 1997.

- At the 42nd Annual General Shareholders Meeting held on March 27, 2008, the abolition of officers’ resignation bonuses was approved. It was also decided that the amount to be paid as of the time of the abolition should be paid, and that the payment should be made at the time each Director or Corporate Auditor resigns.

- The upper limit of monetary compensation claims to be paid to Directors (excluding Outside Directors) for the granting of restricted stock was approved at the 53rd Annual General Shareholders Meeting held on March 27, 2019, as an annual amount not exceeding 50 million yen (excluding the amount of employee salaries).