Compliance/Risk management

At the CAC Group, we believe that the strong awareness of our corporate social and public responsibilities and the actions we take to strengthen social understanding and trust leads to our sustainable development.

To increase our sense of morality and our sincerity as a corporate entity, we have established our policies and systems on compliance and risk management and are striving to maintain these policies and systems.

Compliance

At the CAC Group, we define compliance as “increasing our sense of morality and our sincerity as a corporate entity by complying strictly with laws, regulations, rules and social norms.” Based on Five Values, we have formulated the Basic Guidelines for Business Conduct for Compliance of the overall Group. We have made it our basic compliance policy to establish a system for promoting compliance and to take actions to promote compliance.

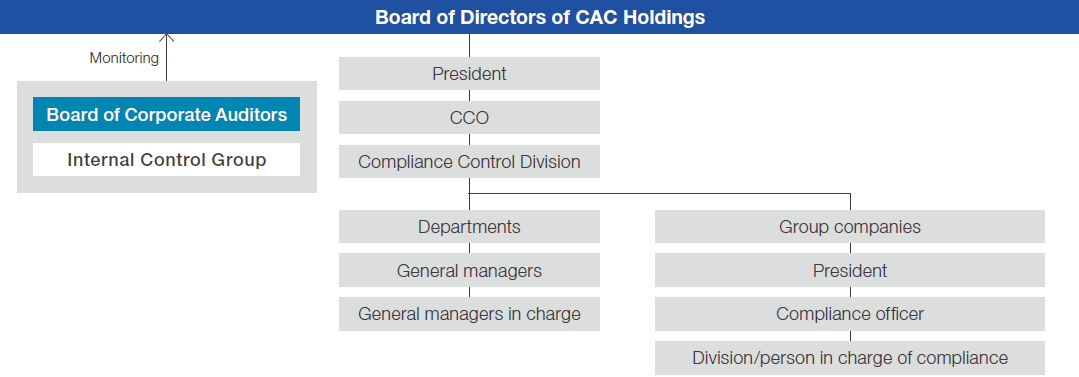

In our system for promoting compliance, we have established a Compliance Control Division, which is a division in charge of legal compliance, under the Chief Compliance Officer (CCO), who is appointed by the Board of Directors.

The CCO supervises the Compliance Control Division, which engages in activities related to compliance, including planning, training, supervision and improvements.

We have also introduced the Compliance Helpline System (a whistleblowing system), which permits employees of the CAC Group to respond appropriately to compliance violations or potential compliance violations that they discover. We operate this system both within and outside the Group.

As our basic policy for eliminating anti-social forces, we at the CAC Group will not be involved at all with any forces or groups that threaten social order and safety, will firmly reject demands from such forces or groups, and will not undertake any trade with any companies, groups or individuals related to such forces or groups.

CAC Group’s system for promoting compliance

Risk Management

In business activities, a company faces not only risks generated in its external business environment but also internal risks that exist within the company.

The CAC Group needs to handle these risks appropriately to maintain and keep improving its corporate value.

At the CAC Group, we have established the Risk Management Principles as basic rules on risk management.

The Risk Management Principles clarify the guiding principle, action guidelines, and risks to manage (such as risks related to disaster, employment, information security, project management and compliance), along with the system to promote the management of these risks.

As the system for promoting the appropriate identification, assessment and handling of risks, we have established the Risk Management Division under the Chief Risk Officer (CRO).

Initiatives for dealing with material risks (as of December 31, 2020)

Major risks that may have a significant impact on the Group’s management and operating results are as follows.

Recognizing the possibility that such risks may materialize, the Group endeavors to prevent them from occurring and appropriately deals with them in the event that they do materialize.

| Risks | Impact on the Group | Countermeasures | |

|---|---|---|---|

| Business environment |

Increasingly tough competitive environment |

Failure to acquire projects will lead to a loss from fewer working hours for personnel and a deterioration in profits from projects. |

|

| Dependence on specific customers and industrial sectors |

Changes in IT investment and management environment of the specific customers and industrial sectors that make up the majority of the Group’s sales will make the Group’s business results highly volatile. |

|

|

| Development of overseas business |

Politics and the economy, foreign exchange movements, legal restrictions, commercial practice, social turmoil, etc. in each country exert an adverse influence over the Group’s overseas business activities. |

|

|

| Corporate acquisition/ Capital contribution |

In the event that capital invested in acquired/ portfolio companies is not recoverable or that additional costs are incurred, it will have an adverse impact on the Group’s operating results, business development, etc. |

|

|

| COVID-19 | The slowdown of economic activity due to the state of emergency declarations and lockdowns has an impact on finances, management results and other aspects. |

|

|

| Business operation |

Value of assets held |

A decline in the value of investment securities and other assets held will have an adverse impact on the Group’s operating results and financial situation. |

|

| Securing and fostering of human resources |

Failure to secure and foster excellent human resources as planned will have an adverse impact on the Group’s business promotion. |

|

|

| Technology | Information security |

Loss, destruction, leakage, etc. of confidential information will lead to a decline in, or loss of, social confidence and/or liability for damages. |

|

| Unprofitable projects |

Excess time spent on development and work will raise the cost of sales ratio. |

|

|

| Suspension of service |

System failure, natural disaster, etc. that disables the provision of systems operation and management services or human resources BPO services will have an adverse impact on the Group’s operating results. |

|

|